Get the Full ERT Credits You Are Eligible for Without the Hassle

Small Business ERTC Help

Employee Retention Tax Credit (ERTC) helps employers whose businesses are negatively affected by COVID-19 to keep employees on their payroll.

Let us help to determine if you are eligible for ERTC. If you are eligible, we will handle the paperwork and filing process to the IRS.

There is no risk to you! We only charge a percentage of what is found during the ERTC process. Save time and don’t pay out of pocket with our tax refund services.

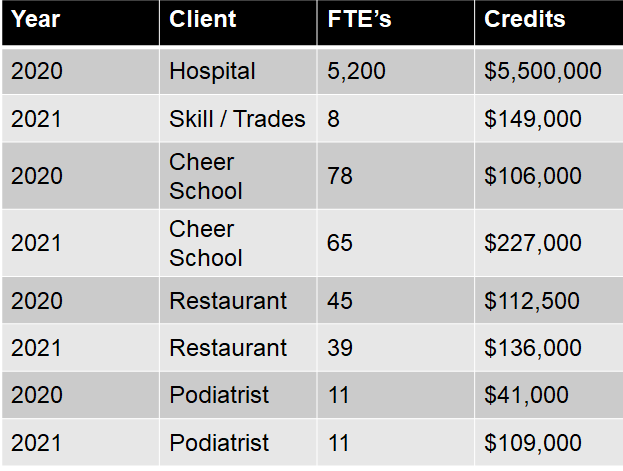

We have processed more than $35M in credits and are not a “fly by night” company. We have served hundreds of small to medium sized businesses across the country for nearly a decade. Let us help you!

Check out some of our recent success stories!

How Our ERTC Process Works

Discovery Session to Determine Eligibility

Discovery Session to Determine Eligibility

Our team will work with you to determine if you are eligible for ERTC and go through next steps.

Amend Returns & Recieve Your Payment

Amend Returns & Recieve Your Payment

We will submit the necessary forms. The IRS will send your tax refund check in the mail.

Clients Who Trust Us

Employee Retention Tax Credit (ERTC) Questions

Discovery Session to Determine Eligibility

Discovery Session to Determine Eligibility

Gather Information to Certify the Tax Credits

Gather Information to Certify the Tax Credits Amend Returns & Recieve Your Payment

Amend Returns & Recieve Your Payment