So, you’re looking to hire an independent contractor in South Carolina. Understanding the classification between independent contractors and employees is crucial, especially when it comes to payroll and taxes. This classification affects how you pay them and report payments to the IRS. Here’s a step-by-step guide to ensure you handle everything correctly.

Are You Hiring a Contractor or an Employee?

Before hiring, make sure you understand the difference between an independent contractor and an employee according to IRS guidelines. This distinction is critical because it determines how you will manage tax reporting and payroll.

Steps to Hiring an Independent Contractor in South Carolina

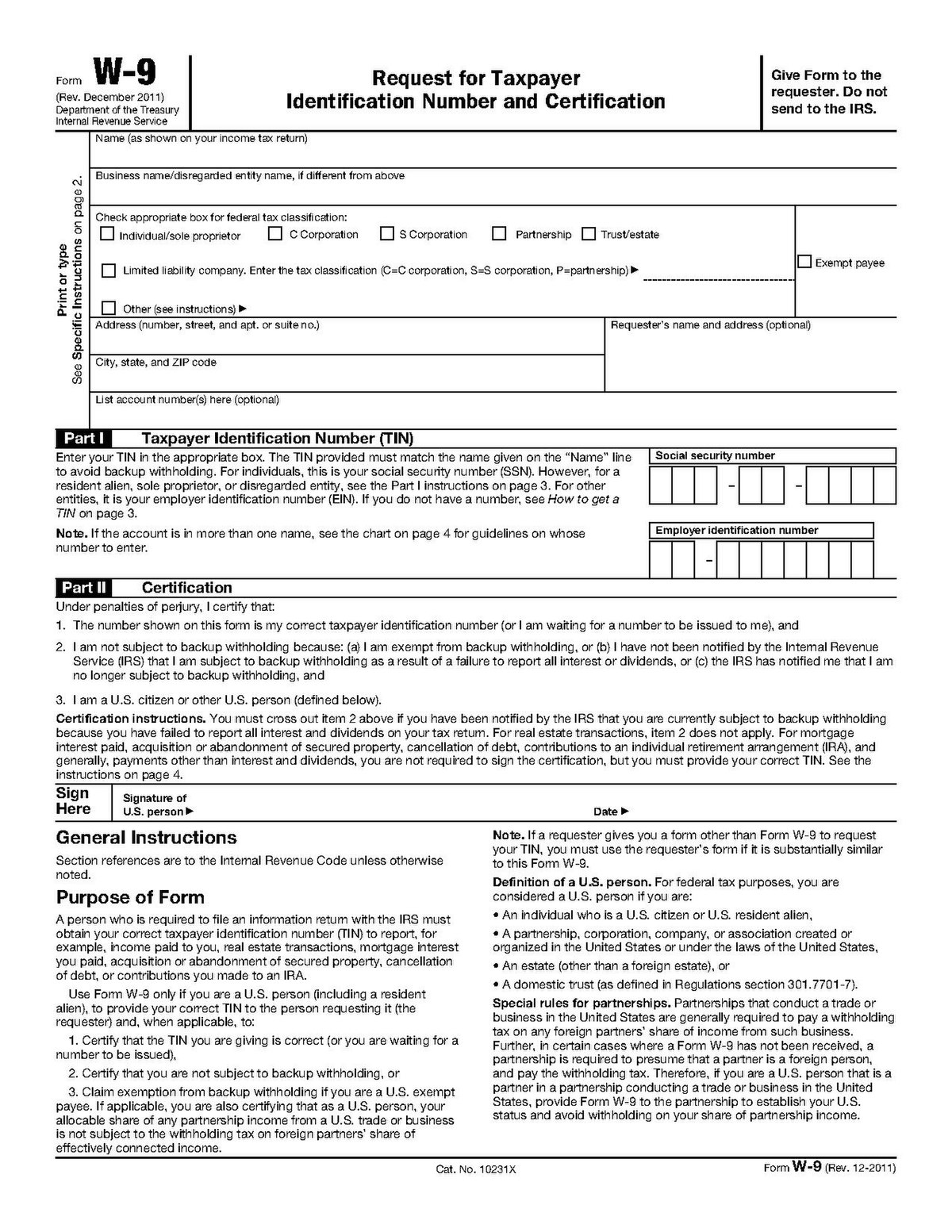

1. Have Your Contractor Fill Out Form W-9

Begin by having your contractor complete Form W-9. This form provides you with essential identifying information. Keep this form in your records for at least four years. Pay special attention to the business classification (i.e., sole proprietorship, S corp, etc.) found on line #3 at the top of the form. This helps determine whether you need to file a 1099-NEC come January.

Additionally, verify if the contractor is subject to backup withholding (line 2 under Part II). If the contractor doesn’t provide a valid taxpayer identification number (TIN) in Part I, you must deduct backup withholding from their earnings. Failure to do so could leave you liable for uncollected tax.

Get the South Carolina W-9 Form Here

2. Pay Your Contractor

In South Carolina, as elsewhere, you generally don’t withhold taxes from payments to independent contractors. Employers can pay contractors through checks, direct deposit (with authorization), or platforms like PayPal. Many payroll providers offer services to process these payments if you already use them for employee payroll.

3. Pay Any Backup Withholding to the IRS

If there is any backup withholding, remit that amount to the IRS promptly. Additionally, ensure any state taxes withheld are sent to the appropriate South Carolina state taxing authority.

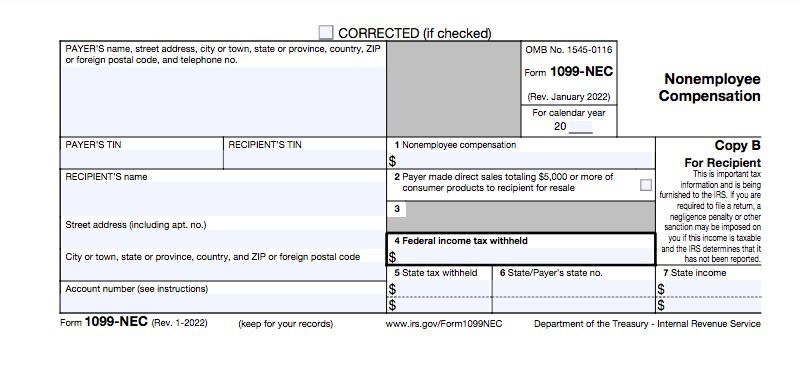

4. Complete Form 1099-NEC

If you pay a contractor more than $600 in a year, and their business entity is not an S corp or C corp, you must file Form 1099-NEC. If you paid them via a credit card or third-party payment platform like PayPal, the payment entity may issue a 1099-K if specific thresholds are met.

Report any federal income tax withheld in Box 4 of the 1099-NEC. Send Copy A of the 1099-NEC to the IRS and Copy B to your contractor by January 31. If this date falls on a weekend, it is due the following Monday.

To mail your 1099-NEC to the IRS, include the required cover sheet, Form 1096: Annual Summary and Transmittal of U.S. Returns. For electronic filing, you’ll need a Transmitter Control Code (TCC). If you don’t have a TCC, request one by filing Form 4419 by November 1 of the preceding year. Use the IRS FIRE system for electronic filing, and send Copy B to your contractor either by post or email (with their written consent).

Check if you need to send the 1099-NEC to South Carolina, the state where the contractor resides, or where they worked. Consult with your CPA to ensure compliance with state and local laws.

Download the 1099-NEC Form Here.

By following these guidelines, you can confidently navigate the process of hiring an independent contractor in South Carolina while staying compliant with all relevant regulations.

Managing independent contractors while staying compliant can be complex for small businesses. Guhroo is here to help South Carolina businesses navigate these challenges with ease. We offer expert guidance and tools to streamline your payroll and HR processes, ensuring compliance with federal and state regulations. Let us handle the details so you can focus on growing your business. Contact us today for a free 60-minute HR diagnosis and discover how we can support your success.